A Virginia sales tax certificate has tremendous benefits. Car dealership licensing registration Motor Vehicle Dealer Board.

How To Use A Virginia Resale Certificatetaxjar Blog

How To Use A Virginia Resale Certificatetaxjar Blog

Obtaining your sales tax certificate allows you to do so.

Resellers license va. Items must be for resale or qualified business use. Step 3 Check the box that represents the sales tax exemption. Resale License in Virginia Overview The state regulates who must obtain a resale certificate in VA and has criteria for in-state and out-of-state dealers.

Fill out securely sign print or email your virginia resale certificate form instantly with SignNow. Retailers Wholesalers Need a Reseller Tax ID a Business License. COMMONWEALTH OF VIRGINIA.

So what is a resale permit. For use by a Virginia dealer who purchases tangible personal property for resale or for lease or rental or who purchases materials or containers to package tangible personal property for sale. A reseller license certifies you dont have to pay sales tax when buying products on a wholesale basis for the purpose of reselling them to customers.

Step 1 Begin by downloading the Virginia Resale Certificate of Exemption Form ST-10 Step 2 Identify the name and business address of the seller. Most businesses purchasing merchandise for resale will choose the first box Tangible personal property for. Employers Need a Federal Tax Id Number EIN a VA State Tax Id State EIN a Business License.

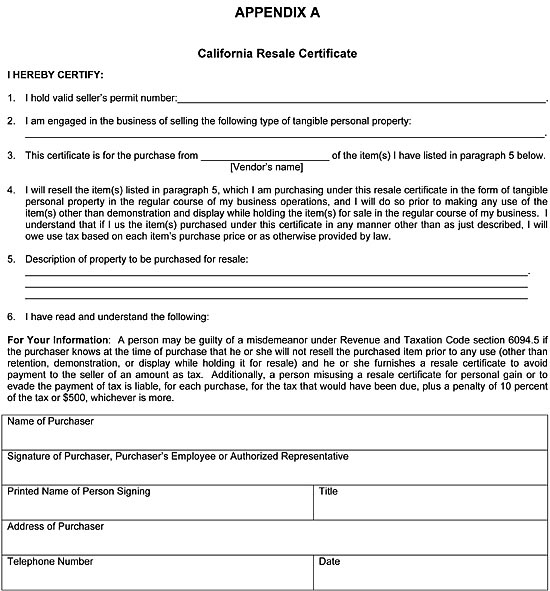

Avoid paying sales tax on purchases. A resellers permit or license is the documentation you need to avoid paying tax on items that youre going to resell to customers. To use a Virginia resale certificate fill out Virginia form ST-10 accurately and completely and present it to the retailer from which you are making your tax free purchase.

It is a permit for sales of taxable items and it is called a sellers permit. Even online based businesses shipping products to Virginia residents must collect sales tax. Steps for filling out the ST-10 Virginia Resale Certificate of Exemption.

All Businesses Need a Gainesville Business License a Trade Business Name Prince William County Trade Business Name required if using a trade name. Resellers License VA Prince William County Haymarket Llc Haymarket 20169 1 What type of permit is a sellers permit. More than 100000 in annual Virginia gross sales or 200 or more transactions to Virginia customers must register to collect and pay sales tax starting July 1 2019.

Marketplace facilitators and remote sellers that have economic nexus in Virginia ie. Generally you need to complete the process of getting the state tax account number whenever youll sell anything physical for which buyers must pay tax and the same applies if you rent property or use services. There is a better way to meet all your legal obligations and get a Virginia Sellers Permit.

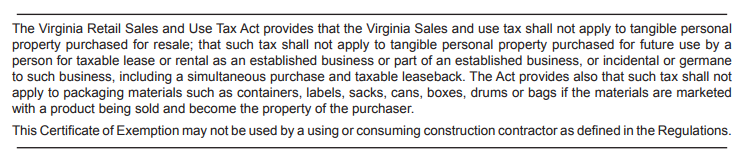

MAY NOT BE USED TO PURCHASE CIGARETTES FOR RESALE. The sales tax for an item only needs to be paid once and its paid by the end customer not you as the seller. This Certificate of Exemption.

Most businesses operating in or selling in the state of Virginia are required to purchase a resale certificate annually. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. To use a Virginia resale certificate you generally must also be registered to collect Virginia sales tax from buyers in the state.

Using LicenseSuite is the fastest way to get your Virginia sellers permit. Generally businesses without a physical location in Virginia that meet the economic nexus threshold should register as an out-of-state dealer and businesses with a physical location should register as an in-state dealer. Apply to be motor vehicle title lender State Corporation Commission.

In some states a reseller license might alternately be called a reseller permit resale license resale certificate sales tax permit or some other term. If you purchase an item from a wholesale organization or even another retailer and are reselling the item in most situations you will be exempt from paying state sales tax. Employers Need a Federal Tax Id Number EIN a VA State Tax Id State EIN a Business License.

Apply for laboratory certification Department of General Services. A resale permit is called resale because in most cases you buy wholesale and you resell retail that is why it is also. Available for PC iOS and Android.

All Businesses Need a Maidens Business License a Trade Business Name Goochland County Trade Business Name required if using a trade name. Obtain an ABC retail license Virginia Alcoholic Beverage Control Authority. Retailers Wholesalers Need a Reseller Tax ID a Business License.

Without LicenseSuite youll likely have to spend hours researching industry specific requirements and applicable governmental requirements from various agencies. Retailers Wholesalers Including Web based Online Websites Home or eBay Businesses Need an VA Sellers Permit AKA state id wholesale resale reseller certificate. Starting an Business Licenses Tax Ids form LLC Incorporation Partnership or Sole Proprietorship HERE IS WHEN YOU NEED A SELLERS PERMIT.

SALES AND USE TAX CERTIFICATE OF EXEMPTION. Almost every wholesale company will require a sales tax number before selling an item or product for resale use. Required for any business in Virginia selling tangible goods.

Also known as a wholesale license sellers permit resale certificate etc. The same applies to opening most commercial resale.